Although it is true that most of us would end up working for over 35 years or so, when it comes to investing for retirement, the ‘effective’ period of investment is really not that long, even if we are disciplined enough to start investing right from the start of our working careers. Let us see why.

A typical scenario we encounter is that our expenses continue to increase as our income itself increases. This may be due to both - the impact of inflation; and given that our needs (or should we call them ‘wants’ instead?) themselves keep increasing as we have more money in our hands. We get used to certain lifestyle during our working life, which is difficult for us to let go in retirement.

As an example, if we are used to living in a metro city (where the expenses are typically high), after retirement it may not be easy living in a smaller town (even though the expenses there are low). Similarly, if we have been using expensive gadgets, driving big cars, going on overseas holidays etc., it may not be easy switching to a cheaper alternative lifestyle – e.g. using public transport, skipping overseas holidays etc.

During the years leading up to retirement when our earnings are typically high, we also adopt a lifestyle that results in high levels of expenses.

Our retirement corpus should, therefore, be sufficient to support this level of expenses, which would increase further due to the effects of inflation.

Let’s assume that we understand the importance of having a retirement corpus that is large enough to provide for our lifestyle-driven expenses, which in turn are linked to our earnings just before retirement.

Let’s also assume that:

Given this, you may ask - “Surely, 35 years of working life would be a long enough period for the magic of compound interest to work and for us to have a large enough corpus at retirement to provide for our expenses thereafter?”

Well, as the table below illustrates, although we may be investing for 35 years, the 'effective' period of our investments is not that long.

| Effective period of investments (if I invest certain proportion of my earnings over 35 years) | |||

|---|---|---|---|

| My investments generate an annual return of | 5.0% | 10.0% | 15.0% |

| My earnings grow annually at | Years | ||

| 8% | 12.0 | 14.2 | 16.3 |

| 10% | 10.5 | 12.5 | 14.7 |

| 12% | 9.2 | 11.0 | 13.1 |

In early years of our working life, we invest relatively smaller absolute amounts (linked to our lower earnings then), whereas we invest larger absolute amounts (linked to our higher earnings then) only in later years closer to retirement. Given this, although we may invest for over 35 years, the ‘effective’ period of our investments is much shorter – only 10 to 15 years (depending on the growth in earnings and the returns our investments generate). In other words, on average, the investments we make have only 10 to 15 years to grow and form our retirement corpus.

Hence, unless we start investing for retirement from the day we start our working careers, this period may be even shorter and we may not build a retirement corpus that is large enough to sustain our lifestyle in retirement.

There is yet another issue to think about - starting to invest from day one of our working careers in itself may not guarantee sufficiency of retirement corpus to sustain our lifestyle. In addition, we may also need to minimise our expenses and maximise the amounts we invest.

Consider the following:

For all these reasons, unless we invest a significant proportion of our earnings during our working life (instead of spending on our ever-increasing ‘wants’), we may not have sufficient retirement corpus to sustain our lifestyle in retirement.

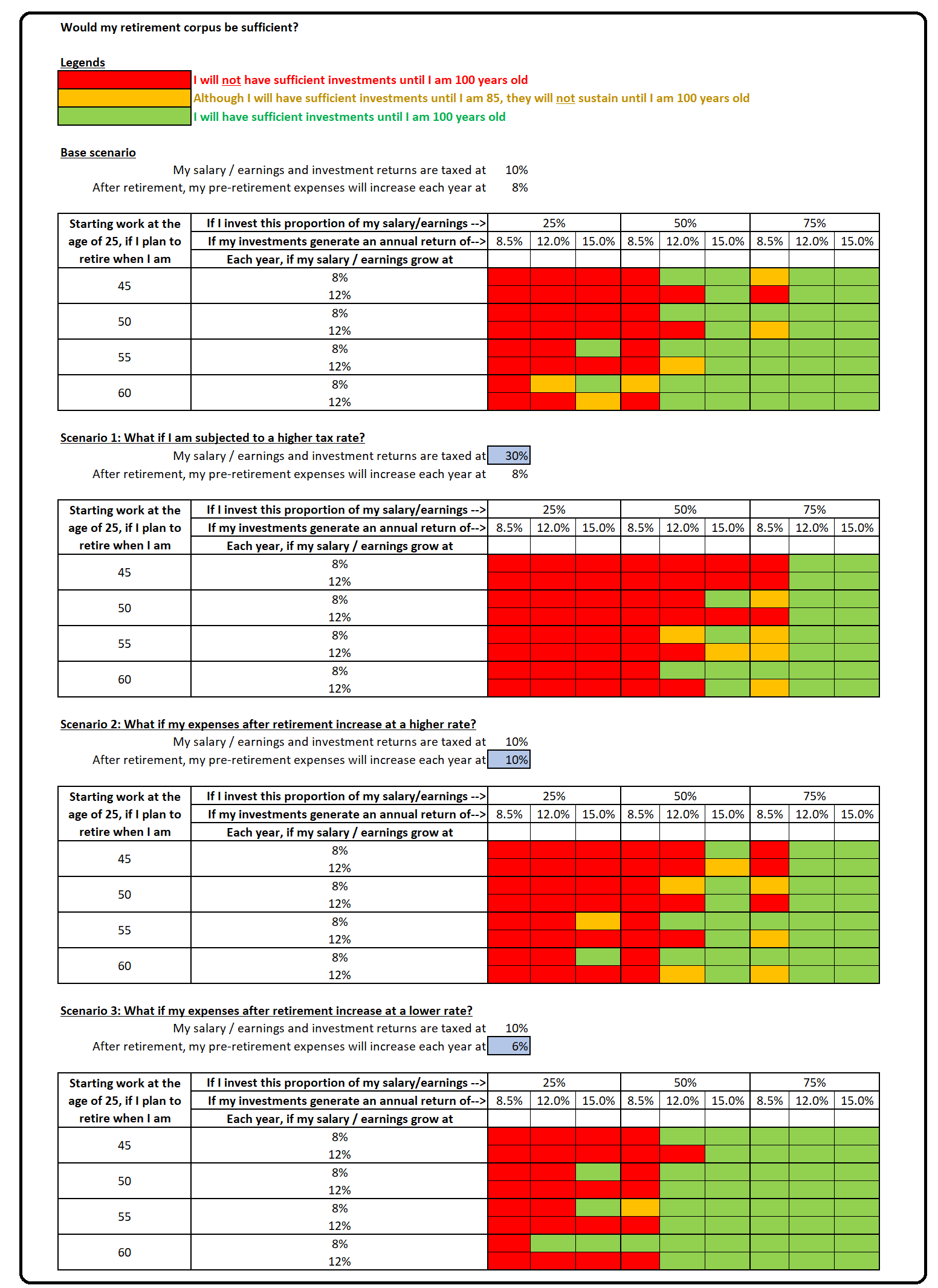

What would be a ‘significant’ proportion? As the tables at the end of this article illustrate, unless we invest at least 50% (ideally 75%) of our earnings each year, we may end up having insufficient retirement corpus.

It seems ironic that we have to start thinking about retirement as soon as we start our working life. The two important points to keep in mind are:

Naturally, everybody’s circumstances may be different than those discussed in this article. Sign into your Fin4sight™ account to generate a personalised financial health assessment report and see if you are on the right track to plan for your retiement.