As per the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI), which was originally launched in 2004, resident Indians are now allowed overseas remittance of any amount up to US$2.5 lakhs in each financial year, for any of the specified purposes (which includes investing in overseas assets).

Over the past few years, this has caught the fancy of many retail investors and High Net-worth Individuals (HNIs) in India, who have started investing overseas in equities and other asset classes. One of the primary routes adopted for such overseas investments is through the ‘Fund of Funds’ (FoF) mechanism offered by the Mutual Funds.

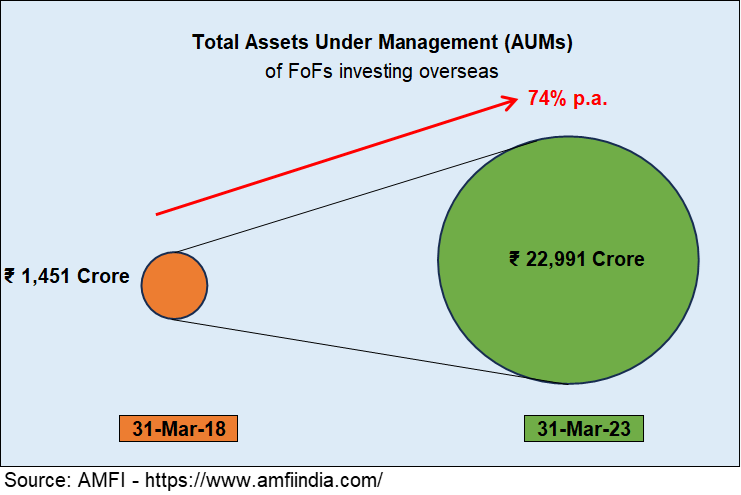

As the chart suggests, the assets under management (AUM) of such FoFs have grown significantly over the past five years ending 31 March 2023, reaching around Rs.23,000 Crores. Out of this AUM, a large quantum (approximately Rs.19,000 Crores as at 31 March 2023, having grown at around 77% p.a.) is due to investments by retail investors and HNIs.

The most preferred FoFs seem to be those investing in equity markets in USA and select Asian & European countries.

So what is driving retail investors and HNIs to invest in overseas equity markets? Are the investment returns in these overseas equity markets significantly higher than what is available in India? Do investors really understand the nuances of different equity markets overseas?

Let’s take a look at the table below, comparing the historical investment returns from the equity markets in India with those from a few other countries:

| Table A - Historical investment returns (in local currencies) over 25 years (from March 1998 till March 2023) based on local equity market indices | |||

|---|---|---|---|

| Country | Index | Investment return (p.a.) | |

| India |  |

BSE Sensex 30 | 11.5% |

| India |  |

S&P BSE 200 | 12.6% |

| USA |  |

S&P 500 | 5.4% |

| Germany |  |

DAX | 4.5% |

| UK |  |

FTSE 200 | 5.0% |

| Japan |  |

Nikkei 225 | 2.1% |

| Singapore |  |

FTSE STI Index | 2.8% |

| China |  |

SSE Composite Index | 4.0% |

| Hong Kong |  |

Hang Seng | 2.3% |

| South Korea |  |

KOSPI 100 | 6.8% |

| Indonesia |  |

IDX Composite | 11.4% |

| Taiwan |  |

TAIEX | 2.6% |

| Malaysia |  |

FTSE Bursa Malaysia KLCI | 3.3% |

Source: Investing.com / Finance.yahoo.com

Considering the table above, only the Indian and Indonesian stock markets have delivered a 'high' investment return of around 11%-13% p.a. over the past 25 years. Stock markets in all other countries seem to be lagging behind, delivering investment returns of around 2%-7% p.a. only.

Of course, with the Indian Rupee (INR) depreciating against other currencies over the same period, the investors’ total returns (when measured in INR terms) would have been higher than this level. The table below shows the annual depreciation of INR against other major currencies over the past 25 years:

| Table B - Annual depreciation of Indian Rupees (INR) against other currencies over 25 years (from March 1998 till March 2023) | |

|---|---|

| Currency | INR depreciation (p.a.) |

| US Dollar (USD) | 2.9% |

| Euro (EUR) | 2.8% |

| UK Sterling Pound (GBP) | 1.7% |

| Japanese Yen (JPY) | 2.9% |

| Singapore Dollar (SGD) | 3.5% |

| Chinese Yuan (CNY) - Note (a) | 4.4% |

| Hong Kong Dollar (HKD) | 2.8% |

| South Korean Won (KRW) - Note (b) | 4.5% |

| Indonesian Rupiah (IDR) - Note (c) | 0.5% |

| Taiwanese Dollar (TWD) - Note (b) | 2.8% |

| Malaysian Ringgit (MYR) | 2.2% |

Notes:

(a) For CNY, the results are based on 17 years' data

(b) For KRW and TWD, the results are based on 10 years' data

(b) For IDR, the results are based on 24 years' data

Source: Investing.com

Based on the two tables set out earlier, the total investment returns (in INR terms) from equity market investments in India and some other countries are summarised below:

| Table C - Historical investment returns (in INR) over 25 years (from March 1998 till March 2023) based on local equity indices and INR depreciation | |||

|---|---|---|---|

| Country | Index | Investment return (p.a.) in INR terms | |

| India |  |

BSE Sensex 30 | 11.5% |

| India |  |

S&P BSE 200 | 12.6% |

| USA |  |

S&P 500 | 8.2% |

| Germany |  |

DAX | 7.3% |

| UK |  |

FTSE 200 | 6.7% |

| Japan |  |

Nikkei 225 | 5.0% |

| Singapore |  |

FTSE STI Index | 6.4% |

| China |  |

SSE Composite Index | 8.3% |

| Hong Kong |  |

Hang Seng | 5.1% |

| South Korea |  |

KOSPI 100 | 11.3% |

| Indonesia |  |

IDX Composite | 11.8% |

| Taiwan |  |

TAIEX | 5.4% |

| Malaysia |  |

FTSE Bursa Malaysia KLCI | 5.5% |

Source: Table A + Table B

The table above illustrates that over the past 25 years, with the exception of India, Indonesia and South Korea, all other countries seem to have delivered investment returns of around 5%-8% p.a. only. Given this, why are many investors flocking to invest in overseas equity markets?

There may have been shorter periods when the equity markets in certain countries would have delivered superior investment returns than those delivered by Indian equity markets. For example, looking at the performance of a few FoFs, some funds investing in the US equity markets have indeed delivered a higher investment return than the 11%-12% p.a. level achieved by investments in Indian stock markets:

| Historical investment returns (p.a.) of FoFs as at 30 September 2023 | ||

|---|---|---|

| Fund Name | Since inception | Over 10 years |

| Franklin Asian Equity Fund | 5.74% | 5.11% |

| Franklin US Opportunities Fund | 14.71% (Note a) | 11.78% |

| Templeton European Opportunities Fund | -0.72% | N.A. |

| Kotak NASDAQ 100 FoF | 8.68% | N.A. |

| Kotak Emerging Markets Fund | 7.17% | 4.43% |

| ICICI Prudential US Bluechip Equity Fund | 15.81% (Note b) | Not available |

Notes:

(a) Return over 11 years 6 months since fund issue at 6 February 2012

(b) Return at 20 October 2023 over 10 years 9 months since fund issue at 2 January 2013

Source: Websites of respective Mutual Funds

However, over a sufficiently longer-term of say 25 years or so, the investors might not have earned a higher investment return by investing in overseas equity markets (although this was not permitted then), than what he might have earned by investing in Indian equity markets.

One could argue that past performance may not be a guide to what may happen in the future. Of course, there is no guarantee that just because historical investment returns were high, that the Indian equity markets would continue to deliver superior returns in the future too. It is possible that the future investment returns in India may be lower due to several factors such as:

However, if one believes in the overall “India growth story”, its demographic dividend (e.g. large pool of young and educated population, significant pool of middle-class with large savings potential), its democratic set-up enabling businesses to thrive etc., it would not be unreasonable to expect that over the long-term, the Indian equity markets may continue to deliver investment returns that are at least as high as, if not higher than, those available from equity markets from several other countries.

Hence, arguably, one should be more bullish about investments in the Indian equity markets in the future. So much so that even overseas investors (including non-resident Indians or NRIs) may find it more beneficial to invest a sizeable proportion of their portfolio in the Indian equity markets.

Before investing in overseas equity markets, one must understand that there are additional risks involved in such investments. The key additional risks include:

However, in spite of the possibility of lower overall investment returns over the longer-term, some may still prefer making overseas investments for the following reasons:

In conclusion, although there may be situations in which overseas investments will be appropriate, one may need to carefully consider the personal circumstances and the various associated risks before taking the plunge to invest in overseas markets. Also, if one decides to invest overseas, given the individual’s unfamiliarity with overseas markets, he may be better off investing through the FoF route available from the Mutual Funds instead of investing directly.